Starting a business is an exciting journey filled with endless possibilities. However, before diving headfirst into entrepreneurship, it is crucial to lay a solid foundation through a well-thought-out business formation strategy. Whether you are a new entrepreneur or a seasoned business owner looking to expand, understanding the intricacies of business formation is paramount.

Here at Incauthority, we understand the complexities of starting a business, which is why we are dedicated to providing top-notch business formation services. We offer comprehensive solutions to help you navigate the intricate process, from establishing your business entity to obtaining necessary paperwork such as Free LLCs and Free Tax IDs. Our team of experts is here to guide you every step of the way, ensuring your business is set up for success.

Alongside the legal and administrative aspects of business formation, we also recognize the importance of accessing business funding and establishing credit. Securing funds to grow your business or kickstart a new venture can be challenging, but with the right strategies, it becomes attainable. Our extensive network of partners and resources allows us to assist you in exploring various funding options and building a strong credit profile, giving your business the financial leverage it needs to thrive.

In this ultimate guide to crafting your business formation strategy, we will delve into the crucial elements you need to consider. From selecting the right business structure to understanding the legal and tax implications, we will provide you with the insights and knowledge to make informed decisions. So, let’s embark on this business formation journey together, setting the stage for your entrepreneurial success.

Choosing the Right Business Formation

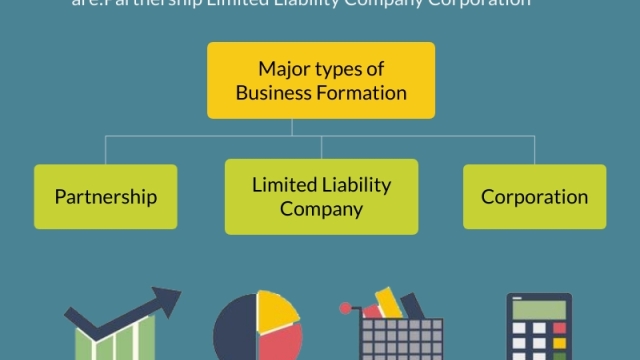

When starting a new business, one of the most crucial decisions you need to make is choosing the right business formation. This decision will impact various aspects of your venture, including its legal structure, taxation, liability, and management. Therefore, taking the time to carefully evaluate your options is essential for setting the foundation for your business’s success.

One of the key factors to consider when selecting a business formation is the level of liability protection it offers. Some structures, such as a limited liability company (LLC) or a corporation, provide personal asset protection, which can safeguard your personal finances in the event of business debts or legal issues. On the other hand, structures like sole proprietorship or partnership may expose your personal assets to business liabilities.

Additionally, understanding the tax implications of different business formations is crucial. For example, certain structures may offer tax advantages, such as pass-through taxation, where the business’s income is allocated to the owners and taxed at their individual rates. It’s important to consider your business’s long-term goals and consult with a tax professional to determine the most tax-efficient option for you.

Lastly, it’s worth considering the flexibility and ease of management provided by different business formations. For solo entrepreneurs or small businesses, structures like an LLC may offer a more straightforward and less bureaucratic approach to administration. Conversely, if you’re planning to seek outside investors or have ambitions for rapid growth, a corporation might be a more suitable choice due to its well-defined governance structure.

By carefully evaluating these factors and seeking professional guidance if needed, you can choose the right business formation that aligns with your goals and sets you up for success. Remember, the formation you select can have long-lasting implications for your business, so take the time to make an informed decision that suits your unique circumstances.

2. Incauthority: Your Partner in Business Formation

Incauthority is your reliable partner when it comes to business formation. With their expert assistance and comprehensive services, you can navigate through the complexities of starting your own business with ease.

They offer a wide range of services to help streamline the process. From obtaining Free LLCs to acquiring Free Tax IDs, Incauthority ensures that your business is established in a legally compliant manner. With their guidance, you can focus on building your vision while they take care of the necessary paperwork and filings.

One of the key benefits of partnering with Incauthority is their expertise in business funding and credit. They understand the importance of financial stability for business growth. Through their network of lenders and credit services, they can help you secure the funding you need to fuel your business’s expansion plans.

Incauthority’s commitment to exceptional customer service sets them apart. They are readily available to answer your queries and provide personalized support throughout the entire business formation journey. With their wealth of knowledge and experience, you can trust Incauthority to be your reliable companion in establishing a strong foundation for your business’s success.

3. Unlocking Business Funding and Credit

In order to fuel the growth and success of your business, it is essential to have access to funding and credit options. With the right strategies, you can secure the financial resources needed to take your business to the next level.

One effective way to access funding is through the assistance of Incauthority. They specialize in helping businesses with their formation services and can guide you in the process of obtaining the necessary funding for your venture. By leveraging their expertise, you can explore various funding opportunities that suit your business needs.

Additionally, Incauthority offers valuable services such as Free LLCs and Free Tax IDs, which can streamline the formation process and make it more cost-effective for entrepreneurs. These services not only save you time and money, but also contribute to the credibility and legitimacy of your business.

Another important aspect of unlocking business funding and credit is establishing a strong credit history. By maintaining prompt payments to suppliers and creditors, your business can build a positive credit profile. This will enable you to secure larger loans, favorable interest rates, and better credit terms in the future.

Furthermore, it is crucial to separate your personal and business finances. Opening a dedicated business bank account and obtaining a business credit card can help you track your business expenses and establish a solid credit history specifically for your venture. By doing so, you will enhance your credibility and demonstrate your commitment to the success of your business.

In conclusion, unlocking business funding and credit is a vital step in the journey of building a successful business. With the guidance of Incauthority and the implementation of sound financial practices, you can gain access to the necessary funding and credit options to propel your business forward. Remember to leverage their expertise in business formation services, consider the benefits of their Free LLCs and Free Tax IDs, and focus on building a strong credit history to maximize your financial potential.